|

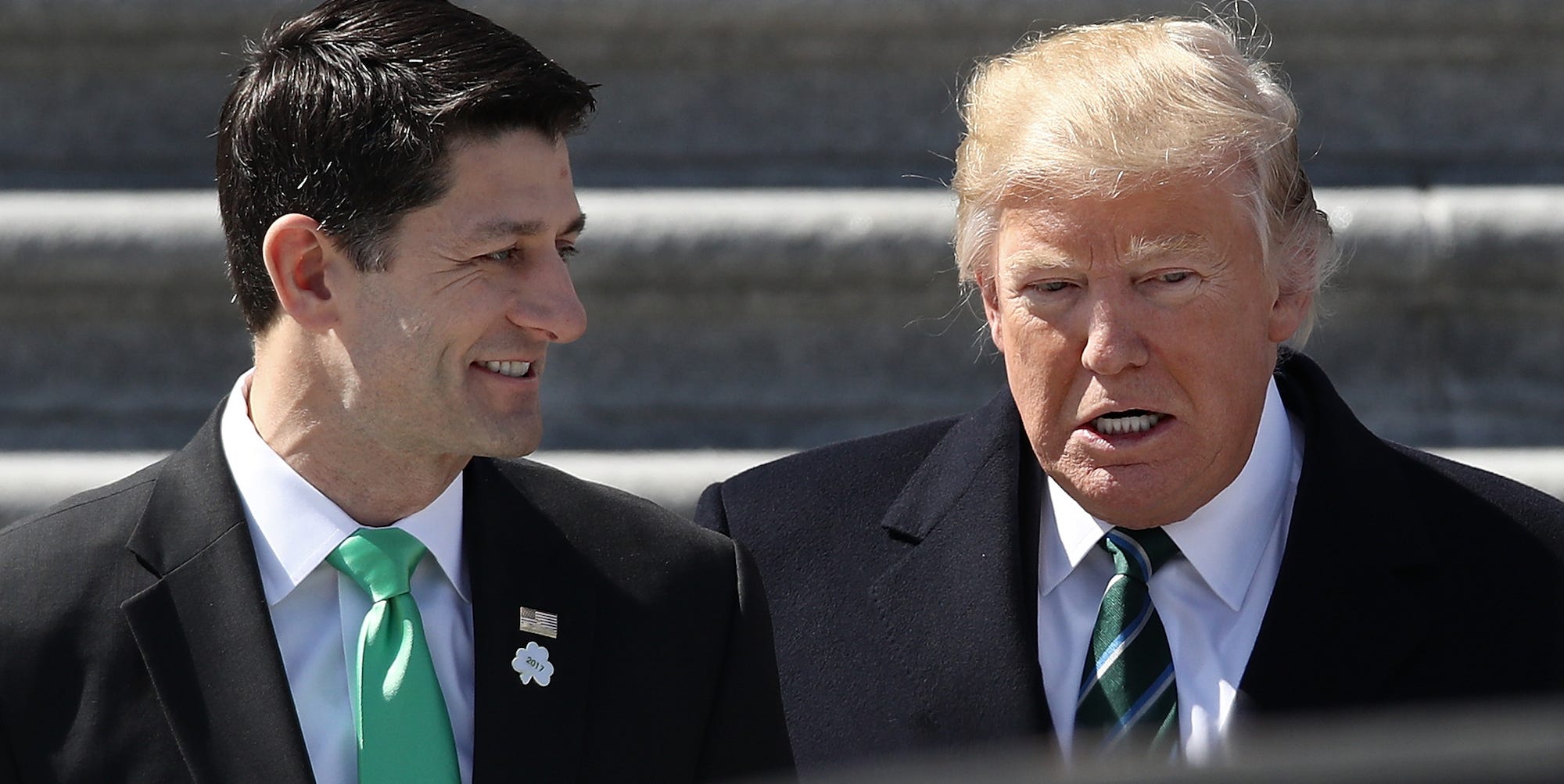

| Two stooges. Where's Mitch? |

The only people who think tax cuts are a good idea are Republican congressional leaders:

Meanwhile, virtually every credible bit of public polling suggests that, if anything, ordinary American think that taxes on big business should be higher, not lower. In September, the Pew Research Center found that 52 percent of Americans thought that corporate taxes should go up; just 24 thought they should go down. In April, 67 percent of adults told Gallup that corporations paid “too little” in taxes. This week, CBS News found that 56 percent of its survey-takers favored a corporate tax hike, while only 17 percent backed a cut.

Weird that the GOPers don't figure this out. "Must have tax cuts!" "Nobody wants them." "But must have tax cuts!"Even among the GOP’s base, corporate tax cuts simply aren’t that popular. Pew found that just 48 percent of conservatives who either identify as Republican or lean towards the party think that corporate taxes should come down; 49 percent thought they should go up or stay the same. Among all Republicans and leaners, including moderates, just 41 favored lowering the corporate tax burden.

They can't figure out how to pay for tax cuts no one wants, or needs.

Earlier Wednesday, tensions were running “very high,” said a source familiar with the eleventh-hour talks. Figuring out how to pay for final changes to accommodate Republican holdouts was just one of several issues that bedeviled Ways and Means members. It was not immediately apparent how they bridged that difference, though making the corporate tax cut temporary could be one of the strategies.

That wasn’t the only problem Republican leaders confronted. Republican tax writers could be heard speaking in raised voices Tuesday night during a more than two-hour meeting at the Capitol. Sources say there was some unhappiness among rank-and-file members who feel the plan has been written largely by party leaders without their input.

“Members on the committee feel their views are not being listened to,” the source familiar with the eleventh-hour talks said.Oh, that secrecy shit. How'd that work our with repealing Obamacare? Meanwhile, observers begin to note that it's completely stupid, even suicidal to press on to gain their ONE FREAKING ACCOMPLISHMENT TO PLACATE THEIR BASE (you know, those people who aren't going to get anything from the tax cuts. Oh well.)

Look at this mess. Speaker Paul Ryan, the zombie-eyed granny starver from the state of Wisconsin, who is perhaps the worst legislative politician since the Five Minutes of Bob Livingston passed into history, desperately needs this win. Passage of this tax bill is the only reason he’s put up with the antics out of Camp Runamuck at the other end of Pennsylvania Avenue. But, unfortunately, those pesky 2018 midterms have put the gallows in everyone’s eyes, especially Ryan’s.

He has salivated for most of his career simply to do away with the estate tax, but he knows that’s also political poison, and that it would help balloon the deficit, which is something he’s supposed to care about, so he’s suggesting they phase it out, in the hopes that nobody will notice that the whole purpose of the thing is to give people like the president* and Paul Ryan the ability to make sure their grandchildren don’t have to work a day in their lives. Tampering with the state and local tax deductions will kill Republicans in high-tax states, where the party’s weak anyway. Capping the deduction for 401(k) contributions is another easy way to turn the middle-class into a ravening horde of angry beasts, and Ryan knows that, too. This would be a tough needle to thread even if Ryan were Sam Rayburn and, as a legislative leader, he’s proven to be closer to Gene Rayburn.Paul Ryan has never been good at this thing, as Paul Krugman has gleefully pointed out (okay, maybe grimly pointed out) more than seven years ago.

Mr. Ryan has become the Republican Party’s poster child for new ideas thanks to his “Roadmap for America’s Future,” a plan for a major overhaul of federal spending and taxes. News media coverage has been overwhelmingly favorable; on Monday, The Washington Post put a glowing profile of Mr. Ryan on its front page, portraying him as the G.O.P.’s fiscal conscience. He’s often described with phrases like “intellectually audacious.”That was then, this is now, and the flimflam doesn't work any better. Ryan's Republicans are trying this time to cut taxes by $5.5 trillion and look for $4 trillion in cut deductions to pay for them. That leaves at least $1.5 trillion in deficits, but for them that's okay (it's wrapped in their budget language, allowing them to do it without shame but most especially without anything but 50 senators plus the yes-voting-bot Mike Pence to break a tie).

But it’s the audacity of dopes. Mr. Ryan isn’t offering fresh food for thought; he’s serving up leftovers from the 1990s, drenched in flimflam sauce.

Mr. Ryan’s plan calls for steep cuts in both spending and taxes. He’d have you believe that the combined effect would be much lower budget deficits, and, according to that Washington Post report, he speaks about deficits “in apocalyptic terms.” And The Post also tells us that his plan would, indeed, sharply reduce the flow of red ink: “The Congressional Budget Office has estimated that Rep. Paul Ryan’s plan would cut the budget deficit in half by 2020.”

But the budget office has done no such thing. At Mr. Ryan’s request, it produced an estimate of the budget effects of his proposed spending cuts — period. It didn’t address the revenue losses from his tax cuts.

This is crap, this is chaos, no one wants it, and it's suicidal for 2018, even though that's ostensibly what they're doing it for. But hey, MENTAL GIANTS 2018!!

No comments:

Post a Comment