|

| Irving Fisher, 1867-1947 |

The following is "tentative conclusion" no. 11 from Irving Fisher's paper entitled "The Debt-Deflation Theory of Great Depressions," 1933. (h/t Paul Krugman)

But the exact equilibrium thus sought is seldom reached and never long maintained. New disturbances are, humanly speaking, sure to occur, so that, in actual fact, any variable is almost always above or below the ideal equilibrium.

For example, coffee in Brazil may be over-produced, that is, may be more than it would have been if the producers had known in advance that it could not have been sold at a profit. Or there may be a shortage in the cotton crop. Or factory, or commercial inventories may be under or over the equilibrium point. Theoretically there may be—in fact, at most times there must be—over- or under-production, over- or under-consumption, over- or underspending, over-or under-saving, over-or under-investment, and over or under everything else. It is as absurd to assume that, for any long period of time, the variables in the economic organization, or any part of them, will "stay put," in perfect equilibrium, as to assume that the Atlantic Ocean can ever be without a wave.Fisher then goes through a number of observations in which he offers the opinion that these "disturbances" just enumerated can only account for "small disturbances" and all of them put together cannot adequately explain "big disturbances."

He gets to the heart of the matter in conclusion no. 19:

I venture the opinion, subject to correction on submission of future evidence, that, in the great booms and depressions, each of the above-named factors has played a subordinate role as compared with two dominant factors, namely over-indebtedness to start with and deflation following soon after; also that where any of the other factors do become conspicuous, they are often merely effects or symptoms of these two. In short, the big bad actors are debt disturbances and price-level disturbances.

While quite ready to change my opinion, I have, at present, a strong conviction that these two economic maladies, the debt disease and the price-level disease (or dollar disease), are, in the great booms and depressions, more important causes than all others put together. [all boldface type mine.]There's no doubt in my mind this analysis nails the cause of our current crisis: the over-leveraging of the big banks, partly for speculative reasons and partly through the selling of dicey mortgage-backed securities in order to keep the housing gravy train running. There's your debt disease. This led to over-leveraged home owners who bought homes in a market seriously suffering from price-level disease.

I then tried to work backwards and ran into a does-not-apply on the recession of 2001 from the deflating of the dot-com bubble. But Fisher to the rescue again, as his no. 20 speaks directly to what happened:

Some of the other and usually minor factors often derive some importance when combined with one or both of the two dominant factors.

Thus over-investment and over-speculation are often important; but they would have far less serious results were they not conducted with borrowed money. That is, over-indebtedness may lend importance to over-investment or to over-speculation.

The same is true as to over-confidence. I fancy that over-confidence seldom does any great harm except when, as, and if, it beguiles its victims into debt.Makes sense to me. The problem with the dot-com bubble was the combination of over-investment and over-confidence. Perhaps the reason it was such a soft recession was that a lot of capital was venture capital that was not borrowed, thus there wasn't so much over-leveraging.

The other really mean recession, the 1981-82 disaster, was caused in classic fashion by the Fed driving up interest rates until it crashed the economy in order to get inflation back under control.

Now, I'm not an economist no matter how fascinated I am with the subject. But it seems clear to me that we've got the price-disease under control: the bottom has fallen out of the housing market, and the correction is well past the half-way mark. The damage, though, is far from over. A good portion of the lingering recession rests on low aggregate demand, as new household formation is so slack that no one needs houses, or construction, or furniture, appliances, etc. The part of GDP that is home-financing-based is also slack, as very little lending is yet underway.

Now what's especially germane, as far as I can tell, is the view of what to do with the debt. And that's where the paradox of thrift comes in. Roughly speaking, what is saved or used to pay down debt is not spent on goods, thus thriftiness causes a lack of economic activity, which then leads to lower demand and higher unemployment.

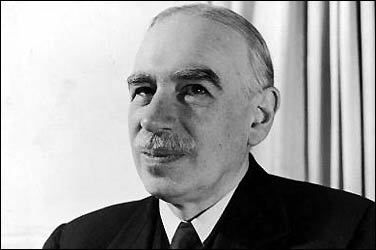

|

| John Maynard Keynes, 1883-1946 |

Therefore, when you've got a national, even world, economy coming out of a serious financial crisis caused by a toxic blend of over-leveraging, over-indebtedness, and price-disease, one of the worst things you can do is create a massive drop in aggregate demand on purpose and expect any good to come of it.

We don't know why the British and the Germans insist on it happening in the UK and the eurozone. We do know that expansionary austerity has all the characteristics of a zombie lie in that the paradox-of-thrift factor alone when applied to government revenues (as in money-not-spent --> lower revenues --> higher deficits --> higher debt) would be the very definition of a vicious circle.

We do know why conservatives insist on it in the U.S.: they want to bring down the Obama administration purely for political gain. We know this because they admitted it. (See Mitch McConnell and Rush Limbaugh.) We know that the conservatives, who like to portray themselves as deficit hawks, don't give a damn about deficits because it they did, they wouldn't have driven the national debt and the deficit so high during the Bush administration.

What's more, they've done everything they can to drive the country into a ditch, and when they had a chance with the Super Committee to really lower the deficit, they didn't do it, and in fact, they've come out of the failure of the Committee demanding that we don't make any of the defense cuts in the sequestration deal but are mum on the Medicare cuts.

|

| We haven't passed any legislation since the Stone Age, I mean since Bush. |

How do we know this? Whenever, and I do mean whenever, reduction of spending on Social Security and Medicare is discussed, it's also discussed with "broadening the tax base," which is blatant code for lowering taxes on the wealthy and raising them on the poor and middle class, under the guise of "everybody should pay something." That's already true -- in that everybody already pays some taxes -- and everybody knows it.

What's also true? This is all being done because the wealthy pay the tab for the pols, who preform like trained animals, to the detriment of the truly needy in our society, with a lot of collateral damage to the ever-shrinking middle class.

Ugh.

The debt disease and the price-level disease (or dollar disease), are, in the great booms and depressions, more important causes than all others put together. [all boldface type mine.

ReplyDeletehttps://www.carlmontpharmacy.com

We have big plans for the backyard once the kids are a little older, like take out all the grass (what little there is), add a water feature,

ReplyDeleteAccess ramps